|

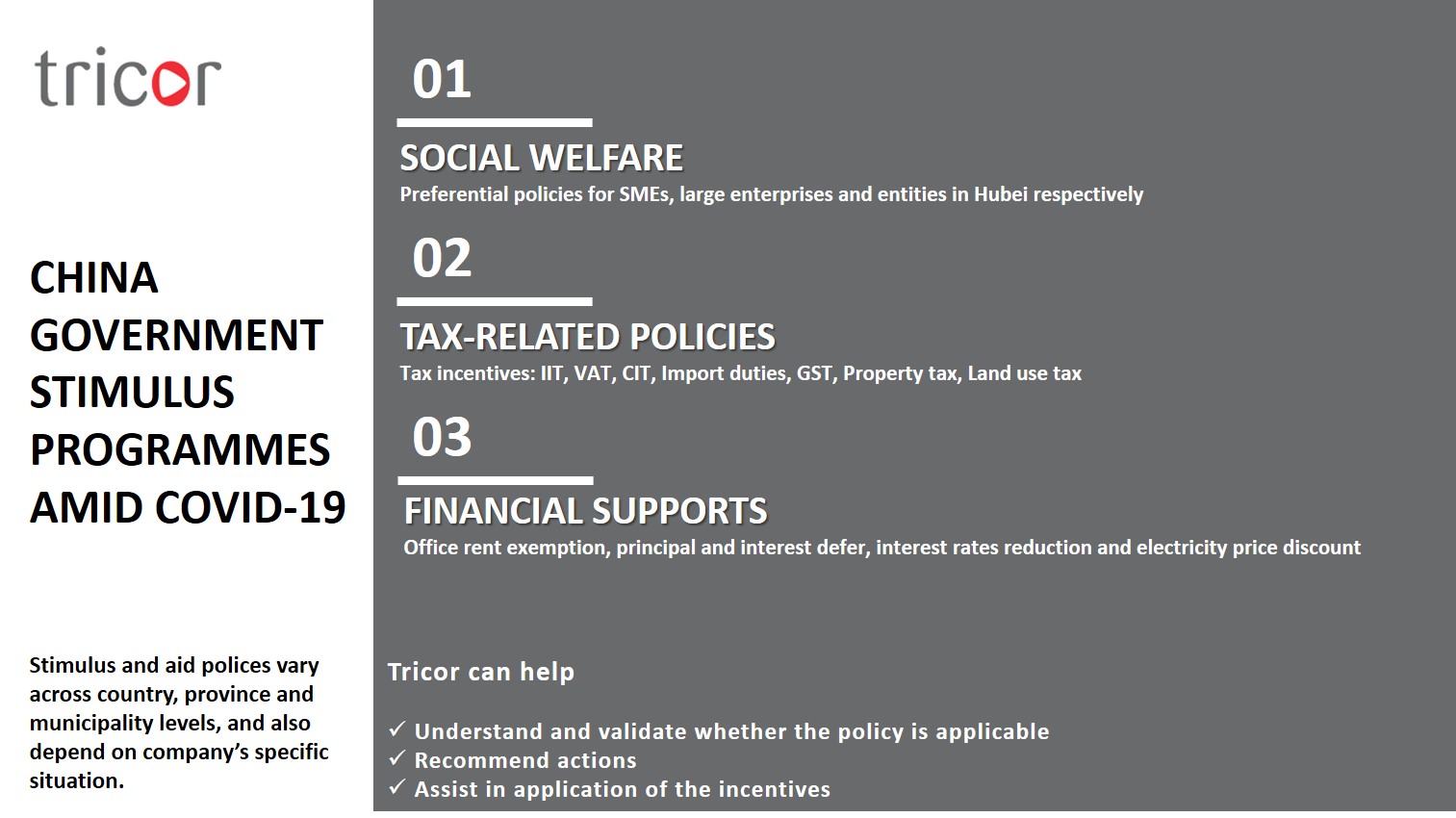

CHINA GOVERNMENT STIMULUS PROGRAMMES AMID COVID-19 - Tricor 卓佳中国In response of the impact of COVID-19 and get the economy back on track, Chinese authorities at all levels of government have been rolling out a multitude of fiscal supporting policies to strengthen enterprises and ensure the resumption of businesses.

China Government Stimulus Programmes amidst Covid-19

SOCIAL WELFARE 1 Feb 2020 - 30 Jun 2020,be given automatically to all industries Published by: Ministry of Human Resources and Social Security, Ministry of Finance, State Administration of Taxation, Ministry of Housing and Urban-Rural Development SMEs Exempt employers’ contribution of pension, unemployment, work related injury insurances with a period not exceed 5 months. l Enterprises experiencing serious operational difficulties due to the epidemic may apply for deferred contribution of social security separately, the deferred period shall not exceed 6 months, and late payment fine shall be waived for the deferred period.Business with a lay-off rate less than 5.5% or fewer than 30 employees with a lay-off rate less than 20% can return 50% of the unemployment insurance premiums they paid in 2019. Large enterprises Halved employers’ contribution of pension, unemployment, work related injury insurances with a period not exceed 3 months. Entities in Hubei Exempt employers’ contribution in Hubei for pension, unemployment, work related injury insurances with a period not exceed of 5 months. All companies l Halve employers' medical insurance contributions with a period not exceed of 5 months. l Housing fund can be deferred if enterprises encounter difficulties to pay but must consult with labor union or employees.

TAX-RELATED POLICIES Published by: Ministry of Finance, State Administration of Taxation, General Administration of Customs Epidemic Prevention & Control l Temporary subsidies and bonus for individual who contributes to epidemic prevention and control will be exempted from IIT. l Protectives provided by employer are exempted from IIT. Materials & Supplies l Fully refund on VAT credit for qualified manufacturing enterprises for epidemic prevention and control supplies. l Exempt VAT on public transportation business, life services and express delivery service for necessities. Donations l Donations through qualified organization or directly donation to hospitals are allowed for a fully deduction before tax. l Donations of goods are exempted from VAT and surcharges. l Donations of imported materials for epidemic prevention and control shall be exempted from import tax, VAT and GST. l The imported materials donated by overseas donors to the recipients for epidemic prevention and control may be exempted from import duties. Resumption of Work & Production l Carry-over period for 2020 losses could be extended to 8 years. l Property tax and land use tax are exempted for rental free period according to local regulations. l Exempt VAT for Small-scale taxpayers in Hubei, and temporally reduce VAT rate to 1% for Small-scale taxpayers in other regions. FINANCIAL SUPPORTS Published by: State-owned Assets Supervision and Administration Commission, China Banking Regulatory Commission, Ministry of Finance, People's Bank of China, National Development and Reform Commission Office rent exemption SMEs can have 3 months’ office rent exempted or reduced if renting from state owned enterprises. Principal and interest defer Principal and interest payments for SMEs due in from January 25th can be extended to June 30th, 2020, and the fine shall be waived for the deferred period. Interest rates reduction Interest rates on loans is reduced, e.g. the people's bank of China has set up a targeted re-lending of CNY 300 billion, with the interest rate of one-year LPR minus 250 BP and a term of one year. Electricity price discounts From Feb 1, 2020 to Jun 30, 2020, the electricity price was reduced by 5%, except for energy-intensive industry users.

Note: Stimulus and aid polices vary across country, province and municipality levels, and depend on company’s specific situation.

For more information, please contact: Phoebe Chen Marketing and Business Development Manager, Tricor China E: Phoebe.Jun.Chen@cn.tricorglobal.com |