|

Industry Pulse about Technology, Business, Media & Human Resources

Introduction BritCham Guangdong connects and promotes businesses in the Greater Bay Area and bridges British business with Chinese enterprises. Every month BritCham Guangdong brings you news from our members which you may want to know about - Pulse offers you up-to-date industry insight through a 20-min read. BritCham Industry Pulse aims at joining the dots between our members and their market sectors.

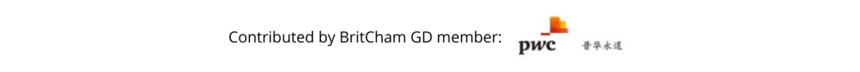

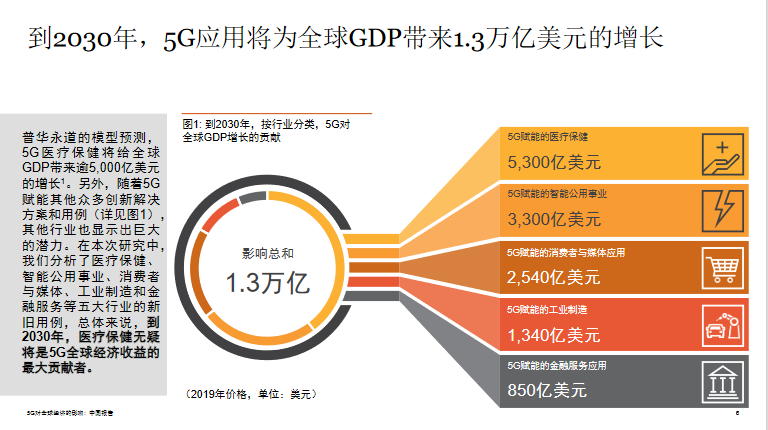

5G对全球经济的影响: 中国报告 赋能未来 商业世界对5G前景的热议已经持续数年。与前几代移动技术相比,5G的速度更快、时延更低,连接设备的数量也大幅度增加,这让企业高管们看到一个更高效、高产的未来。5G为全方位的超高速宽带构建了基础,因此它将带来4G或Wi-Fi6无法比拟的可能性。为适应后疫情时代,企业领导者们也开始考虑如何以最佳方式修复、反思和重构业务,5G的前景在今天变得更为重要。随着5G应用和推广速度的加快,我们可以开始用经济术语来量化这项技术的潜在影响。基于专家的洞见并借助经济模型,我们从用例层面对5G技术的影响作出评估,重点关注五大行业——医疗保健、智能公用事业、消费者与媒体、工业制造和金融服务。这些行业都将从5G技术中获得显着收益,我们同时也计算了到2030年这些行业可能获得的具体收益。与任何此类分析一样,绝对数值仅起到定向作用,只有在相互比较时才最有意义。根据我们的研究,超过80%的经济潜在收益集中在医疗保健应用(预计将为全球GDP贡献5,300亿美元)、智能公用事业管理(3,300亿美元)以及消费者与媒体应用(2,540亿美元)。加上贡献较小的其他行业,预计将带动1.3万亿美元的经济增长。聚焦中国5G发展, 随着“新基建”(新型基础设施建设)持续升温,各地政府相继出台新基建行动方案,5G建设成为行动方案中的“必选项”;深入挖掘5G技术,5G深度融入百业,为数字政府、智慧城市、工业互联网提供支撑,带来巨大的经济和社会价值。根据我们的研究,预计到2030年,5G对中国经济的影响为2,200亿美元。有鉴于此,领导者在规划企业未来十年发展时,必须对5G倾斜更多的战略关注——既要考虑5G所处的发展阶段、在行业内进一步发展5G所能带来的竞争优势,同时又要考虑自身是否能够满足必要的条件与要求,使5G技术应用得到突破性进展并创造价值;此外, 重视业务发展的同时也要重视安全发展,实现“双轮驱动”。

目前,中国5G网络处于规模建设的中期,5G商用对经济社会的影响主要体现在投资拉动和终端消费牵引。放眼长期,5G开启数字经济新篇章,以5G为代表的新型信息通信基础设施不仅将进一步拉动信息消费,还将成为社会信息流动的主动脉,进一步促进智能连接、云网融合贯穿到各行各业生产环节,充分释放数字对经济发展的倍增作用。推动ICT产业进入增长新轨道•5G商用带动运营商进入投资新周期,中国内地三大运营商5G相关网络资本开支在2020年达到1,700亿元, 预计2021年也将超过1,700亿元4,占总资本开支比重将超过54%;•5G推动新型基础设施持续创新,电信运营商、互联网巨头、ICT设备提供商、第三方数据中心提供商纷纷加码云计算、数据中心和人工智能等投资;•推动信息消费转型升级,2020年中国内地三大电信运营商业绩稳中有升,移动通信业务ARPU止跌转增;5G手机终端大规模出货。打造经济社会创新发展新空间•为其他行业生产方式变革提供新途径,随着融合应用的演进,5G赋能千行百业的经济价值逐步体现,如帮助传统行业实现低成本的远程操控;•为社会治理和公共服务方式变革提供新可能,以5G海量连接能力与交通、医疗、 教育、 娱乐等行业融合,刺激升级消费,改善城市和居民的生活体验。 关于《5G对全球经济的影响: 中国报告 赋能未来》的更多详情, 请点击此处.

Retail’s Realignment The road ahead for omnichannel in the Greater Bay Area Connecting online-to-offline (O2O) channels to deliver improved customer experience Our survey suggests that a large proportion of consumers expect retailers to provide an integrated offline-to-online experience: 77 percent of Hong Kong respondents and 85 percent of those polled in mainland China GBA cities said retailers need to have a better connection between channels to create a seamless customer journey. Responses to our consumer survey help define what customers are looking for throughout their online-to-offline retail journey, including the type of engagement they expect from retailers. Product authenticity rates highly among shoppers, but convenience is just as important throughout the customer journey. Self-service options to reduce waiting times together with a personalised and interactive experience – optimised on mobile – all rated highly in the survey (Figure 2.1). Customers seem more satisfied generally with the checkout, payment and delivery processes compared to our previous survey in 2019. But they remain less satisfied with product quality, the ability to customise products and customer service, both before and after purchase.

Understanding the ‘generation gap’ in consumer preferences The generation gap in shopping behaviour has widened since the start of the pandemic. A growing phenomenon of “tribalism” is permeating the retail landscape. As we noted in our 2019 study, “tribal” groups of consumers interact with brands in different ways according to their loose demographic group. Our interviews with industry executives for this year’s report confirm the continuation of this trend, with retailers saying they are facing challenges with how to interact with these different consumer groups. With so many brands marketing on online channels, particularly since the onset of the COVID-19 pandemic, retailers are under pressure to provide offers that can entice these increasingly demanding subsets of customers. The Generation Z gap The standout demographic group is Generation Z (“Gen Z”), which includes those born from 1995-2010. Gen Z is well known as the first generation of consumers to have grown up knowing no other world than one constantly connected by digital devices, particularly smartphones. These consumers are putting experience at the centre of their purchasing journey. Unsurprisingly, according to our survey, the majority of Gen Z consumers polled consider themselves “mobile savvy” (88 percent of those in mainland China GBA cities, 69 percent in Hong Kong) and “tech savvy” (76 percent of mainland China GBA cities and 69 percent in Hong Kong)

For more details about Retail’s Realignment The road ahead for omnichannel in the Greater Bay Area, please click here.

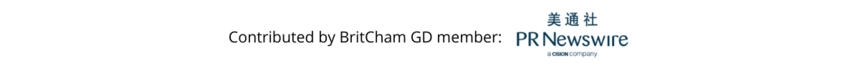

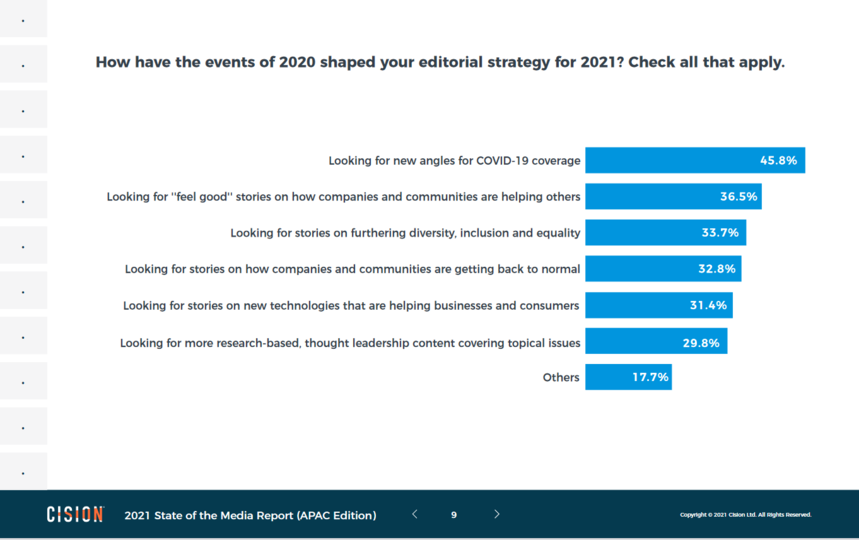

2021 Global State of the Media Let’s Get Started With Some Key Takeaways: l Journalists’ views on public trust in the media have steadily improved over the last five years, but the challenge continues. While journalists were the most likely to report a loss in public trust in the last year, they were also somewhat optimistic that this trend will improve going forward. l Anticipating, monitoring and quickly acting on trending stories will become even more critical for PR pros. With fragmented news consumption and increased competition for eyeballs, journalists are closely evaluating whether a story idea has the “it factor” that will translate into traffic and social shares (and ultimately ad revenue). l Journalists are both overwhelmed and underwhelmed by pitches. PR pros need to build highly targeted media lists. More than 1 in 4 journalists receive over 100 pitches per week with most ending up in the virtual trash due to irrelevance. l And, contrary to popular belief, a sizeable percentage say they like receiving pitches on Friday, Saturday and Sunday. l Journalists want PR pros to help make their jobs easier. With journalists covering several beats and stories per week, they’re looking for press releases that are chock full of original research, graphics and invites to interview experts or attend events. l PR pros should avoid pushing journalists’ biggest buttons. Pitches that sound like marketing brochures, lack of transparency and following up repeatedly are among the top pet peeves for journalists.

For more details about 2021 Global State of the Media, please click here.

中国科技行业报告 随着国内外企业从疫情中复苏并为未来做准备,中 国的科技产业再次向好,未来一年的关键词是“缓 慢转型”。 这一进展的关键是国产科技产品的使用。 一个原因 是,在当前充满变数的时期,企业需要削减成本, 并认识到这些产品更符合中国市场要求,尤其是在 垂直行业的使用。 中国在人工智能领域处于世界领先地位 这一点在本土人工智能的推进上尤为明显,自 2016 年中国政府启动 五年人工智能计划以来,该领域进展迅速。 第二个计划(即三步走 战略)的目标是到 2030 年,将中国建设成为人工智能领域的全球领 导者。中国还计划建立一个以人工智能为重点的技术研究园区,进一 步实施这一计划,而阿里巴巴、腾讯和百度等互联网巨头也都宣布了 投资意向。 不过,推动中国科技行业迈向全球高地的不仅仅是这些行业巨头,还 有人工智能初创企业。在中国,这类企业的数量正在攀升。2020 年 的一份报告显示,自 2016 年以来,非上市公司已融资 300 亿美元, 而在近 100 家估值至少 10 亿美元的私营企业中,大多数是人工智 能创业公司。 引领这一变革的先锋是本土的高级专业人员,他们看到了市场内在的 机会,利用其专业知识、本土网络和资源来创业,以发掘这个肥沃的 市场。 随着技术在国内的进步以及技术知识基础的不断增强,该行 业可能会转向新的方向,推动该地区的招聘机会。 对大数据专业人才的迫切需求 尽管对全球大数据价值的估计各不相同 — 一些研究认 为 2020 年大数据价值为 1380 亿美元,另一些则预测 到 2022 年将达到 2740 亿美元 — 但毫无疑问,这是 中国要抢占的又一个前沿领域。 无论是教育、交通、健康还是零售业,大数据被用于日 常生活的方方面面。因此,据称中国拥有全球近 60% 的大数据专家也就不足为奇了。 中国已经成为“全球大数据分析的中心”,为应对疫情带 来的经济影响,本地出口商正在利用这些数据来开拓中 然而有证据表明,年轻的科技人才十分排斥这种工作模 式,因此希望吸引高技能年轻人的公司正在摒弃旧的工作 模式。 一个典型例子是字节跳动,该公司推出了 “大小周” 政策,允许员工每周交替工作 6 天和 5 天。 这种承诺缩短工作时间、减少加班时间的做法只是中国更 灵活的工作文化的开始。其他举措包括 :更多远程办公的 可能性,以及关注员工的心理健康,如提供零食、下午茶 和健身等福利。 此外,希望吸引海外人才的科技公司在努 力营造更开放的企业文化,同时赞助更多行业活动以推广 企业品牌。 国市场。 结果,正如许多公司看到的那样,尽管专业人才 看起来很多,但仍然存在巨大的人才缺口。 中国可能会通过教育和职业培训来弥补短缺,目前一些大 学开设了大数据课程,并有可能与领先企业建立合作关系。 然而,由于目前的需求量巨大,而且必须即时满足,因此 国内企业和跨国公司都将目光转向来自欧洲和美国的海外 人才 ;对顶尖人才的争夺非常激烈。 关于《中国科技行业报告》的更多详情, 请点击此处。 Want to contact BritCham members who contributed to the above reports? Want to contribute your report to BritCham Newsletter? Please contact events@britchamgd.com |