|

Industry Pulse about Finance, Business, Education & Real Estate

Introduction BritCham Guangdong connects and promotes businesses in the Greater Bay Area and bridges British business with Chinese enterprises. Every month BritCham Guangdong brings you news from our members which you may want to know about - Pulse offers you up-to-date industry insight through a 20-min read. BritCham Industry Pulse aims at joining the dots between our members and their market sectors.

2021 State of Investor Relations

How will the Investor Relations industry shape up in 2021? – especially after a challenging year when many IR teams around the world had to find new ways to connect with stakeholders in the financial community – from portfolio managers, shareholders, analysts to retail investors. Cision, our parent company, teamed up with the U.S.-based National Investor Relations Institute (NIRI) to show how IR teams took on one of the most challenging years in modern history and adjusted strategies for 2021 (and beyond). With the rise of many social issues, more companies also placed emphasis on their Corporate Social Responsibility (CSR) and Environmental, Social and Governance (ESG) initiatives. The study, The State of Investor Relations in the Virtual World, features interviews and survey insights from senior IR leaders across the U.S. Get the report for an inside look at:

For more details about 2021 State of Investor Relations, please click here.

Travel Retail Market in Hainan FTP – Towards A Golden Future

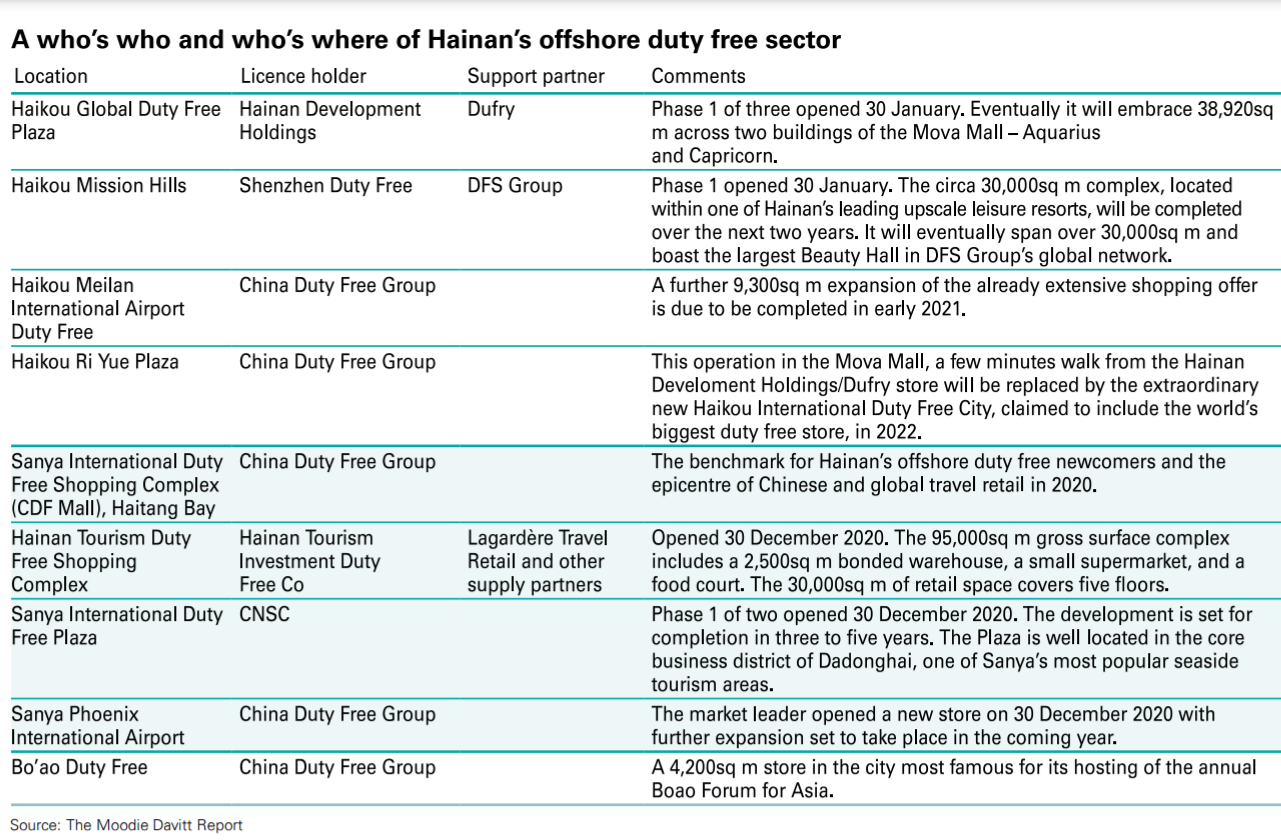

It is a great pleasure for KPMG China and The Moodie Davitt Report to jointly publish this white paper on the Hainan Free Trade Port’s offshore duty-free sector to mark the opening of the inaugural China International Consumer Products Expo. The Expo is a landmark event in the ambitious development of the Hainan Free Trade Port (FTP) , a project of national and regional importance. The rapid development of the offshore duty-free sector in Hainan province since 2011 has played a key role in Hainan’s growing allure and status as an international tourism consumption centre. By the end of 2020, the offshore duty-free business was worth approximately USD5 billion, boosted by the introduction of an enhanced shopping policy in July 2020, which gave tremendous impetus to brands in the channel as other duty-free markets fell into a deep pandemic-driven slump. The story of Hainan FTP’s offshore duty-free industry represents a triumph of policy, a pro-business, pro-consumer approach that is core to President Xi Jinping’s vision of ‘dual circulation’ and of maximising domestic consumption – in this case by repatriating overseas travel shopping to China.

This white paper considers Hainan FTP’s offshore duty-free business within the context of a global duty-free industry that was worth USD86.4 billion in 2019 (pre-COVID). It documents the relentless rise of the business from 2011 to 2020 and notes how Hainan FTP became the ‘lighthouse’ of travel retail last year as other markets collapsed. We examine the various policy enhancements that have spurred the business, including a proliferation of retail licences in 2020 that created greater competition in the sector and will help raise standards for the benefit of Chinese consumers. For more details about Travel Retail Market in Hainan FTP – Towards A Golden Future, please click here.

The new digital landscape: Managing risk and building resilience

Digital transformation hit full speed in 2020, as organisations and individuals adapted to new ways of living and working in the wake of the COVID-19 pandemic. Trends already underway, such as remote and cloud-based working, were accelerated, and the adoption of new technologies, such as artificial intelligence (AI), the internet of things (IoT), blockchain and beyond, started to gain ground. Both early and late adopters were swept along by the demands of a more virtual world. Like never before, technology demonstrated its power to connect, drive operational efficiency and enable differentiation. And amid such rapid change, an agile approach to compliance and risk management has become vital for survival. At Clyde & Co, our technology, cyber and data specialists have seen first-hand that rapid digital change has brought new risks and liabilities, ranging from a rise in cyber attacks to data privacy concerns, people and employment issues, and the need to balance innovation with compliance. In this report, we assess some of the major digital trends that our team saw come to the fore during the pandemic, the risks and opportunities that these trends introduced, and how businesses can use these transformational times to their advantage to ensure that they emerge stronger and more resilient than ever in a post-crisis world. For more details about The new digital landscape: Managing risk and building resilience, please click here.

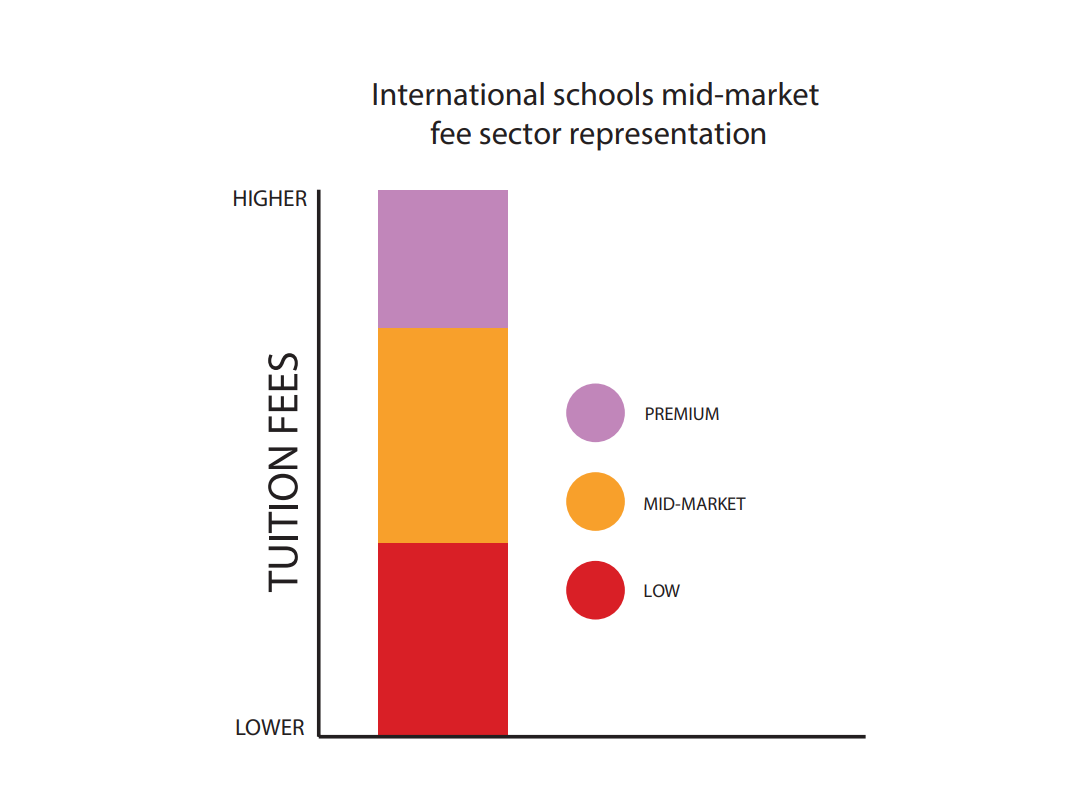

WHITE PAPER: The growing demand for international schools within a mid-market fee point

The last two academic years have shown a notable growth in demand for international schools with a mid-market fee point. Mid-market fee international schools meet the educational needs of a large population of families in most countries. A lower fee point does not necessarily imply compromised education standards. There are many reasons why school fees at a lower price point to others may be offered within a locality. Our team has done further research to help you better understand this growing segment of the global international schools market.

For more details about WHITE PAPER: The growing demand for international schools within a mid-market fee point, please click here.

Prospects for prime growth across the UK

Throughout the unprecedented events of the past year, the housing market has shown it can perform in isolation of the wider UK economy. People's desire to move has outweighed uncertainty surrounding jobs and finances. This has been particularly true of the prime markets where affluent buyers are less reliant on the mortgage market, are likely to have some established housing equity and have remained more financially secure. Our forecasts consider the factors shaping values in the prime London and regional markets. For more details about Prospects for prime growth across the UK, please click here. |