|

Industry Pulse about Education & Business

Introduction BritCham Guangdong connects and promotes businesses in the Greater Bay Area and bridges British business with Chinese enterprises. Every month BritCham Guangdong brings you news from our members which you may want to know about - Pulse offers you up-to-date industry insight through a 20-min read. BritCham Industry Pulse aims at joining the dots between our members and their market sectors.

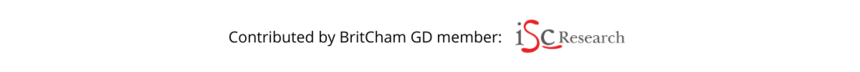

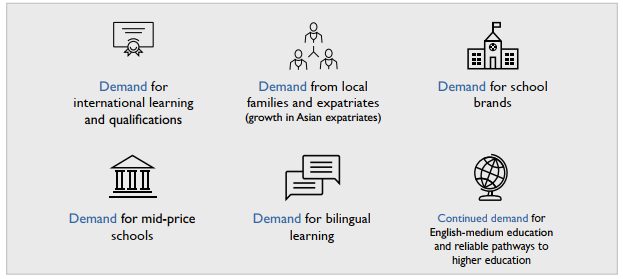

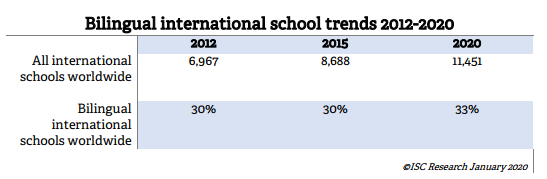

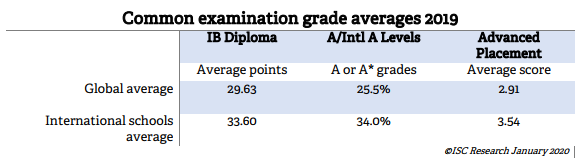

Why and how independent schools open sister schools overseas... and what next for this education sector? Recent months have seen the closure of at least 25 independent schools in Britain with some sources placing the number as high as 30. Recent months have seen the closure of several long-established independent schools around the world; at least 25 independent schools in Britain with some sources placing the number as high as 30 . Many more independent schools are being forced to consider mergers as the financial effects of COVID-19 are felt. Faced with this, and along with other challenges, independent schools are increasingly looking at diversification for alternative sources of income, one of which is foreign development. Taking an independent school into a foreign market offers several benefits that directly impact the founding school. It broadens enrolment potential, extends awareness of the school brand overseas, and creates exchange and career opportunities, as well as raising income. The international schools market is a sector that has grown immensely over the past 20 years. In 2000 there were 2,584 schools, offering an international education in English to just shy of one million students and generating US$ 4.39 billion in fee income.Twenty years on, there are now (July 2020) 11,616 international schools, attended by 5.98 million students generating more than US$ 54 billion in fee income.

For more details about Why and how independent schools open sister schools overseas... and what next for this education sector? , please click here. Why parents select an international school, and the impact of COVID-19 on school choice In 2000, when ISC Research was already researching the international schools market, the industry was made up of 2,584 schools serving children from age 3 to 18, with 969,000 students and 90,000 teachers. Thirty years ago, international schools typically provided education for the children of Western expatriates at embassy or community schools and usually offered a US or UK curriculum delivered wholly in English. Expatriate parents often had little choice of education provision for their children who were invariably unable to access local schools due to language, curriculum or legislation barriers. This resulted in many schools being set up by companies needing to provide for staff with young families, or by parents who were seeking international education and addressing a direct need for their own children. Over the last thirty years that market has evolved considerably. At the close of the 2019-2020 academic year there were 5.98 million students being educated in 11,616 international schools by 554,000 teachers. What was once a provision of necessity, almost exclusively for Western expatriates, is now meeting the desires of many people of many nationalities. Today, according to ISC Research analysis, just 20% of the total international school student population have expatriate status. The greatest demand (80%) is from local families. In most global cities of the world, parents now have extensive education choice including a wide range of international schools. Some are provided by large international school groups such as Nord Anglia, GEMS and International Schools Partnership, others by independent school brands operating overseas such as Brighton College, Dulwich College, Dwight School and Chadwick School, other international schools are operated by private proprietors, or by local brands, and there are also international schools run by foundations, governments, embassies and charities. Online international schools are also emerging. Today there are both for-profit and not-for-profit international schools.

For more details about Why parents select an international school, and the impact of COVID-19 on school choice, please click here.

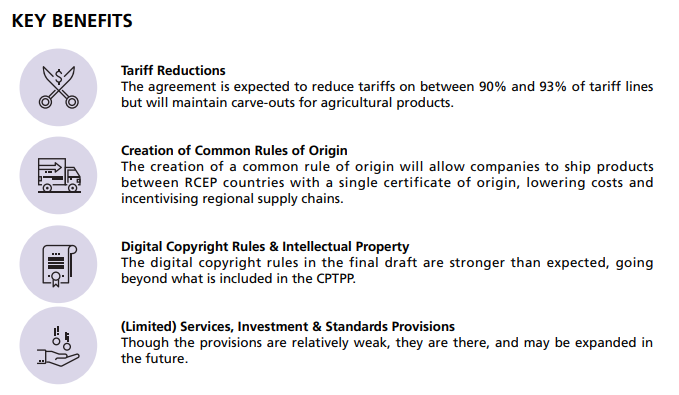

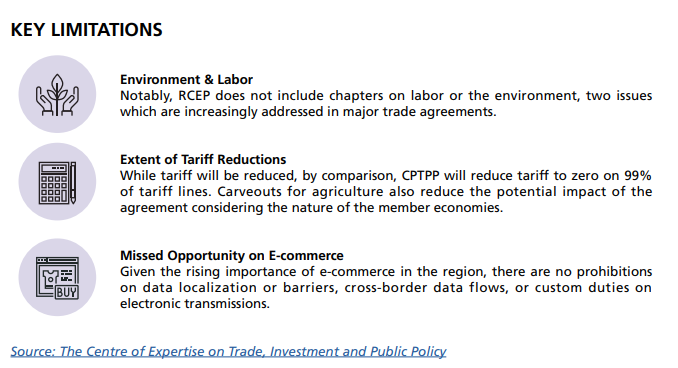

APAC Regional Comprehensive Economic Partnership Agreement (RCEP) and COVID-19 Recovery We are pleased to release Tricor Group 2021 Asia Pacific Trade Report, which focuses on how the landmark signing of the Regional Comprehensive Economic Partnership Agreement (RCEP) in November 2020 and continued COVID-19 disruptions are impacting the Asia Pacific (APAC) trade and investment landscape and how to prepare to deliver business growth in 2021. This analysis was developed through the aggregation and synthesis of quantitative and qualitative industry data from a multitude of research and media sources. The formation of the RCEP trade bloc is indisputably a defining moment for international trade ¨C a new, highly welcome development that could redirect foreign direct investment flows in the months and years ahead. Notably, the RCEP is even larger than the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which is still in force and was previously the largest free-trade area involving Asia Pacific. At Tricor, we are highly cognizant of gauging how this trade deal will potentially divert trade flows and trigger new business trends. What starts as a large-scale, high level agreement between governments across Asia will likely soon trickle down to impact the daily decisions multinational corporations and SMEs make in how they operate, expand and invest, across domestic, APAC and international markets.

Want to contact BritCham members who contributed to the above reports? Want to contribute your report to BritCham Newsletter? Please contact events@britchamgd.com |