|

Industry Pulse about Logistics, Banking, Cap Rates and WorkspaceIntroduction BritCham Guangdong connects and promotes businesses in the Greater Bay Area and bridges British business with Chinese enterprises. Every month BritCham Guangdong brings you news from our members which you may want to know about - Pulse offers you up-to-date industry insight through a 20-min read. BritCham Industry Pulse aims at joining the dots between our members and their market sectors.

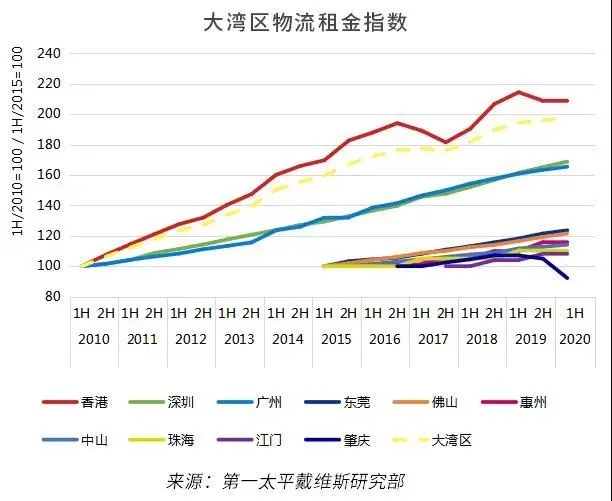

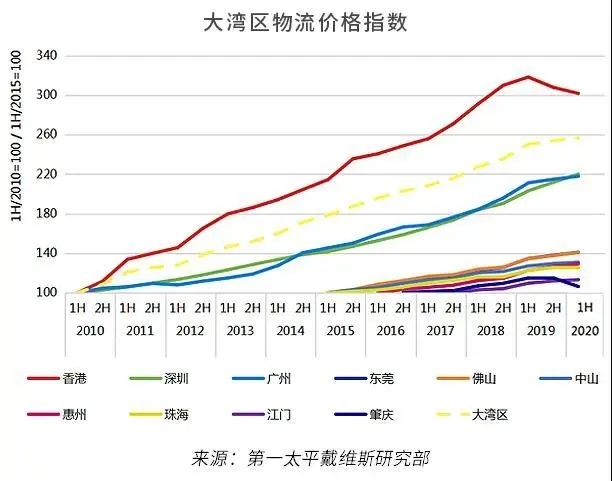

2020第一太平戴维斯重磅发布《大湾区物流指数》报告

欲了解更多关于2020第一太平戴维斯重磅发布《大湾区物流指数》报告,请点击此处。

大湾区 “跨境理财通” 启动 2020年6月29日,中国人民银行、香港金管局和澳门金管局联合公布开展粤港澳大湾区“跨境理财通”业务试点框架内容,粤港澳大湾区居民可跨境投资由区内银行销售的理财产品。 继中共中央、国务院于2019年2月印发了《粤港澳大湾区发展纲要》及有关机构于2020年5月发布了《关于金融支持粤港澳大湾区建设 的意见》后,“跨境理财通” 是另一推动粤港澳大湾区金融服务便利化的重要举措,旨在促进大湾区整体发展。我们认为,“跨境理财通” 将有助 (1)促进大湾区内投资理财多样化和便利区内资本流动;以及 (2)推动人民币国际化,强化香港作为国际金融中心和离岸人民币业务枢纽的地位。

欲了解更多关于大湾区 “跨境理财通” 启动,请点击此处。

APAC Cap Rates Report | Q2 2020 The retail market has generally continued to have weak performance due to the ongoing effects of COVID-19, with increases in cap rates from 0.25% to 0.5% in over 50% of the APAC cities covered in this report. For more details about APAC Cap Rates Report | Q2 2020, please click here.

Flexible Workspace Outlook APAC | 2020

In January, we predicted five flexible workspace trends to watch. These included enterprise outsourcing becoming mainstream; highly amenitised assets with best-in-class hospitality being ‘table stakes’ for any new office development; a continued boom in wellness offerings; and a revival of suburban locations and further operator fragmentation. The impact of COVID-19 has accelerated these trends, while new trends – such as the integration of home as a place of work and the growing importance of the digital experience – have also emerged. For more details about Flexible Workspace Outlook APAC | 2020, please click here. Want to contact BritCham members who contributed to the above reports? Want to contribute your report to BritCham Newsletter? Please contact events@britchamgd.com |