|

Industry Pulse about COVID-19 | February 2020

Up until 24th February, COVID-19 has caused approximately 77,000 confirmed cases and over 2,500 deaths globally. Since February, the Chinese government has been assisting retail and corporates companies alike to resume economic activity, in phases based on city level and the monitoring of the coronavirus spread. While manufacturing activities in the next few weeks will resume back to normal, with those who are capable of producing medical supplies have already resumed their work, however many service sector may still be affected until April, probably May in some cases. There is no direct guide from the Public Security Bureau yet on when public gatherings can occur. The ripple affect of the outbreak is yet to be fully felt, with a bounce back of potential job losses as the scale of the impact is assessed and felt – President Xi was quoted as saying it's a ‘Big Test' to combat the virus, the test itself will be if businesses can handle the mounting debt that companies may have to bear to pay workers and suppliers during this ‘freeze’. Banks are being asked to offer more credit as millions of companies are trying to stay afloat – BritCham GD predict a tough year for many SME’s across China, Guangdong is no different yet there is hope that the Pearl River Delta region has held its own with the strong GDP growth in south China, will pass this economical test still.

During this virus outbreak, through BritCham GD member’s discussions have indicated that a few major industries have been affected substantially.

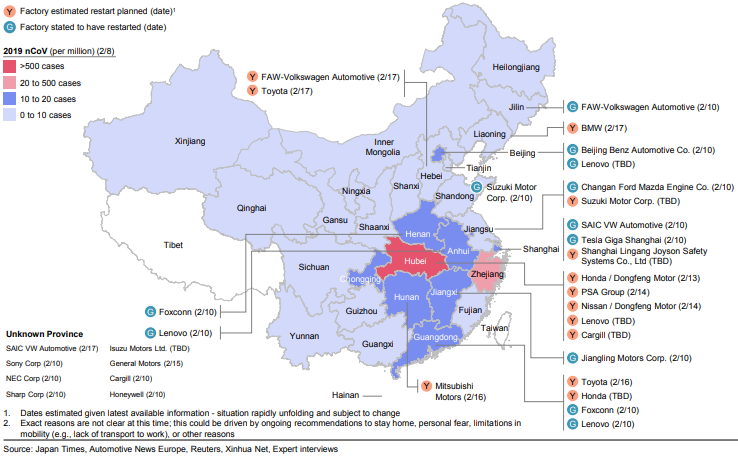

Since 2003, China has established itself as an automotive powerhouse and now serves as a major supplier to global automakers, which makes COVID-19 poised to be much more disruptive now.

Computer, electronic, optical products, electrical equipment, other machinery and equipment and motor vehicles and trailers are the most impacted manufacturing sectors in this epidemic due to concentrated operations near the affected areas and components often heavily customized, making it challenging for factories to relocate outside of China in the short term.

Image source from McKinsey The outbreak comes at a time of already slumping sales, heightened trade tensions and dampened forecasts — China auto sales fell 2.8% in 2019 amidst global trade tensions, the first decline in nearly two decades. More than 60% of Chinese automotive light vehicle production is based in provinces currently affected by government mandated production shutdowns, leading to an estimate of US$9Bn productions losses per week. It’s not just about production, but sales too, the BBC news reported that during the lunar festival period, car sales in China fell 92%, selling only 811 vehicles in total.

In today's world, China is one of the largest contributors for outbound travel and tourism spending. As the longest public holiday in China, Chinese New Year is one of the most important periods for tourism industry globally. According to McKinsey Global Institute, in 2019, CNY period accounted for nearly 10% of the total tourism year spending. Hence, this lunar holiday should have been a busy business period for many travel agencies and hotels.

Due to this outbreak, the industry is greatly dampened with travel bans by over 50 countries or territories. At the time of writing, the airline industry has predicted US$30Bn in loss of earnings, with further losses to tourism business in countries such as Australia and Japan; along with forecasted hit on the cruise line industry due to the number of affected cases on one such liner in Japan. Consumer confidence on such luxury holidays will take time to recover.

Closer to home, all restaurant and hotels have close to zero profit, some 5-star luxury hotels reporting only 4 guests in total at one point; with bars closed for business and restaurants switching to creating online delivery services – only returning district by district in the major cities of Guangzhou and Shenzhen for seated dining.

Since social gathering has been curbed in China with it slowly being allowed, albeit restricted in terms of proximity, customer flow in domestic boutiques and luxury shopping malls has plunged and it has afflicted the demand for non-staple luxury goods such as wines, spirits. As a result, 24 of British brand Burberry’s 64 stores in Mainland China are closed with remaining stores operating with reduced hours and seeing significant footfall declines.

With factories closing for such a prolonged period, designer brands as well as phones and luxury cars have seen product shortages. At the same time, the lack of Chinese shopping tourism has seen profits plunge for some luxury houses – UK luxury goods expert say that Chinese shopping tourism accounts for 1 job for every 20 Chinese tourist visiting the UK.

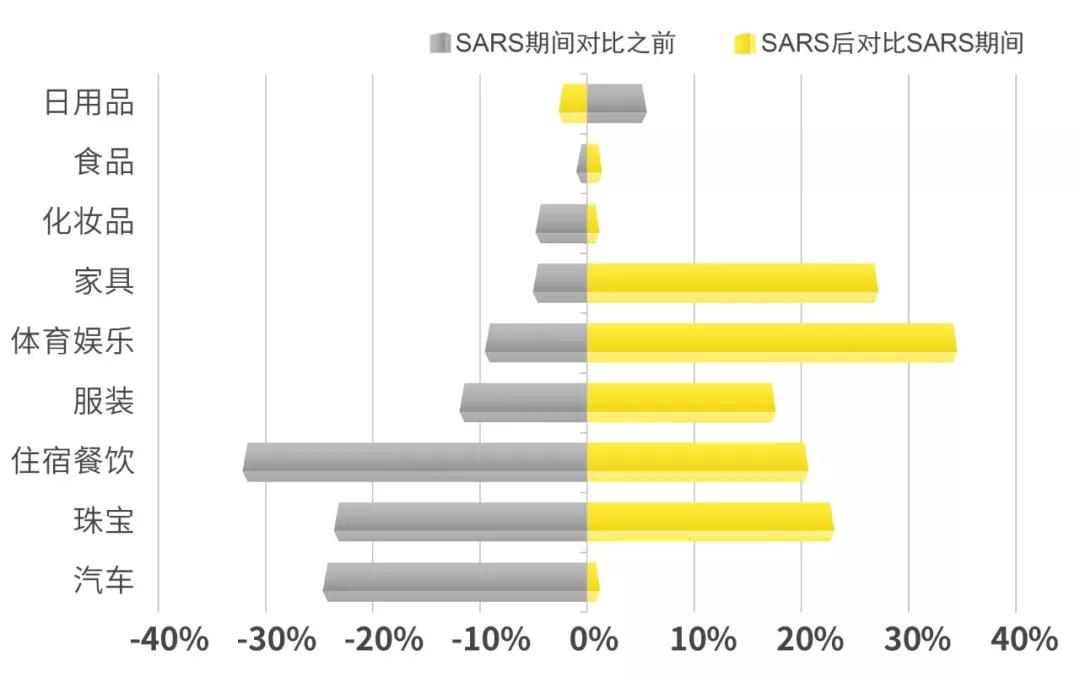

Similar to tourism industry, the luxury sector is likely to, as with SARs, rapidly recover once disease is perceived to be “under control”, which means that customers deferring their spending rather than not spending at all. Consumer confidence will take longer to return than economic restart. Consumer spend to remain muted until Q2 2020; but; if the disease peaks by April/May, recovery would start in 2H2020.

Image source from Mckinsey

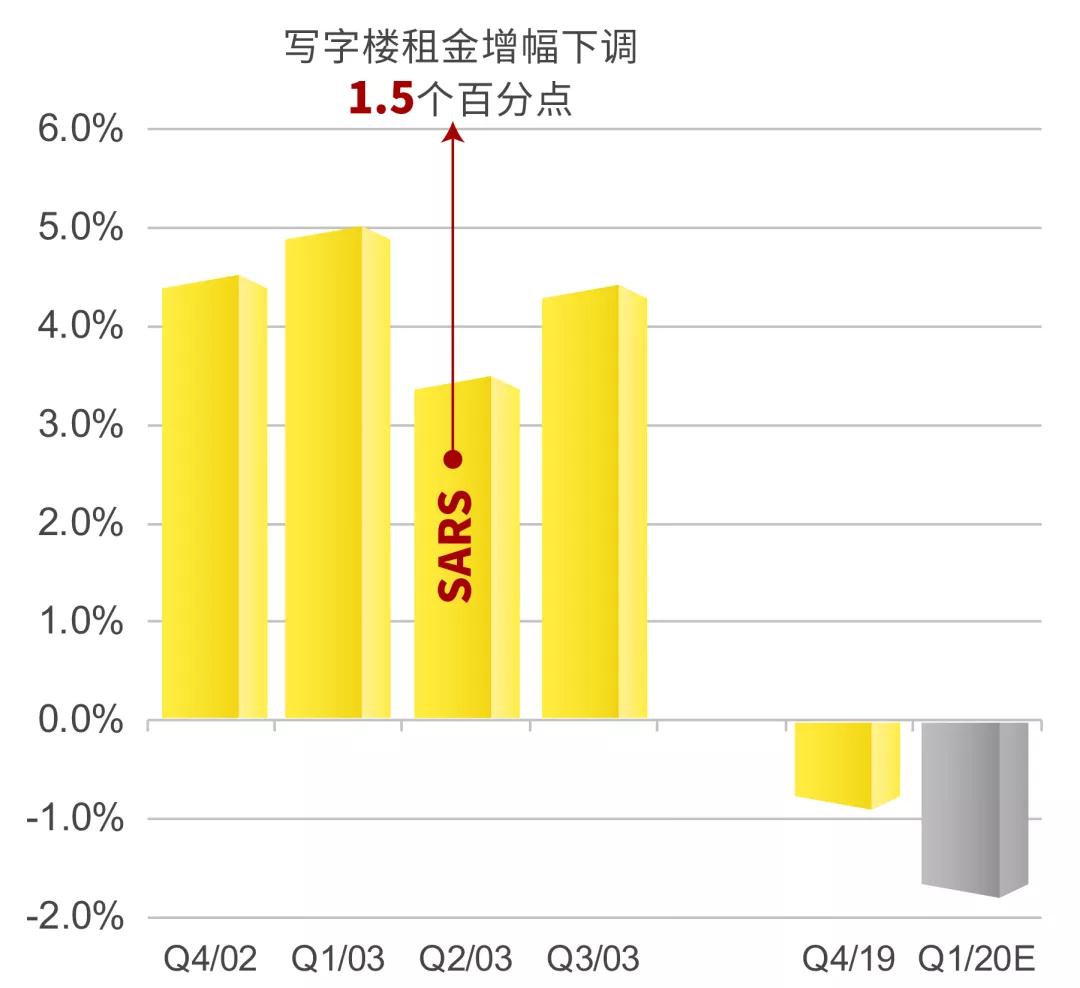

拐点之后,经济复苏将循序渐进 尽管短期难免经历大幅冲击,但支撑中国长期发展的基本面不变,经济增速亦将随疫情结束而回归潜在正常速率。预计随着改革推进,将吸引更多外资涌入中国。而疫情引发的思考与经验将引导政府完善治理水平,优化社会环境。 新冠疫情发生正值经济转型时期,预计后续复苏将聚焦深化改革、产业升级、区域一体化、跨部门协作等关键领域。 房地产细分市场的韧性与机会 办公楼市场: 短期承压,关注重点行业

零售市场: 各业态影响不同,期待反弹

住宅市场: 核心城市积压需求有待陆续释放

高端服务式公寓市场: 挖掘新兴需求机会

投资市场:回归核心城市

更多关于疫情影响下的房地产行业资讯,请点击此处 Want to contact BritCham members who contributed to the above reports? Want to contribute your report to BritCham Newsletter? Please contact events@britchamgd.com Reference: Coronavirus COVID-19 Crisis Response - Mckinsey |